The 6-Minute Rule for Tulsa Bankruptcy Lawyers

The 6-Minute Rule for Tulsa Bankruptcy Lawyers

Blog Article

When financial challenges pile up, and it feels like you might be sinking deeper into debt, it’s straightforward to sense like there is no way out. But hold on, because there is hope. Bankruptcy can seem like a Frightening phrase, but in reality, it could be a lifeline. Should you be in Tulsa and battling too much to handle financial debt, then Tulsa individual bankruptcy attorneys are your go-to allies. They specialise in guiding you with the murky waters of individual bankruptcy, aiding you navigate the elaborate authorized landscape to uncover relief and, most of all, a new start out.

So, why ought to you think about achieving out into a Tulsa personal bankruptcy lawyer? Permit’s be real—managing personal debt may be puzzling and overwhelming. The legal jargon on your own may make your head spin. That’s where these legal professionals can be found in. They stop working the law into bite-sized, comprehensible parts, so you can also make informed choices about your money future. Irrespective of whether It is Chapter 7 or Chapter thirteen, Tulsa personal bankruptcy legal professionals will stroll you thru the choices, helping you comprehend which path is greatest suited to your exclusive condition.

Fascination About Tulsa Bankruptcy Lawyers

You could be considering, "Do I really want a lawyer? Can’t I just file for individual bankruptcy myself?" Confident, you can seek to tackle it on your own, but it surely’s like attempting to deal with a broken car or truck with out figuring out what’s under the hood. Individual bankruptcy laws are intricate, and one Mistaken shift can cost you major time. A Tulsa bankruptcy attorney knows the ins and outs of these legislation and can help you keep away from common pitfalls that might derail your circumstance. They’re just like the mechanics on the lawful planet, great-tuning your circumstance so you have the best possible result.

You could be considering, "Do I really want a lawyer? Can’t I just file for individual bankruptcy myself?" Confident, you can seek to tackle it on your own, but it surely’s like attempting to deal with a broken car or truck with out figuring out what’s under the hood. Individual bankruptcy laws are intricate, and one Mistaken shift can cost you major time. A Tulsa bankruptcy attorney knows the ins and outs of these legislation and can help you keep away from common pitfalls that might derail your circumstance. They’re just like the mechanics on the lawful planet, great-tuning your circumstance so you have the best possible result.One of many critical roles of the Tulsa bankruptcy lawyer is to guard your property. Submitting for individual bankruptcy doesn't necessarily suggest you’ll get rid of all the things you own. With the proper legal assistance, you may normally keep the dwelling, car, and personal belongings. Tulsa personal bankruptcy lawyers know the exemptions and protections that could be placed on your scenario, making sure that you choose to hold as much within your assets as possible though having rid of your personal debt that’s weighing you down.

Permit’s look at pressure. Credit card debt could be an enormous source of worry, influencing almost everything out of your wellness for your interactions. The frequent calls from creditors, the looming threat of foreclosure, and the panic of wage garnishments—it’s ample to keep you up at night. But any time you seek the services of a Tulsa personal bankruptcy law firm, they acquire that load off your shoulders. They handle the negotiations with creditors, the paperwork, as well as courtroom appearances. You get to breathe a little bit less complicated knowing that knowledgeable is within your corner, fighting on your monetary liberty.

Now, you could marvel, "How do I pick the correct Tulsa individual bankruptcy lawyer?" It’s a fair dilemma. Not all lawyers are established equal. You’ll want another person with encounter, a demonstrated track record, and, most significantly, a person who helps make you are feeling comfortable. Individual bankruptcy is a private make a difference, and You'll need a law firm who listens, understands, and genuinely desires to help you. Don’t be afraid to shop all over. Meet using a several legal professionals, inquire queries, and rely on your intestine. The right lawyer can make all the real difference.

Submitting for individual bankruptcy is a major decision, and it’s not 1 for being taken flippantly. It’s imperative that you understand that bankruptcy isn’t a magic wand which will instantaneously fix all of your troubles. It’s additional similar to a reset button. Certainly, it may possibly wipe out sure debts and offer you a fresh new get started, but it also comes along with consequences, for instance a strike on your credit rating score. That’s why possessing a Tulsa bankruptcy lawyer by your side is very important. They assist you weigh the pros and cons, so you know exactly what you’re stepping into before you decide to take the plunge.

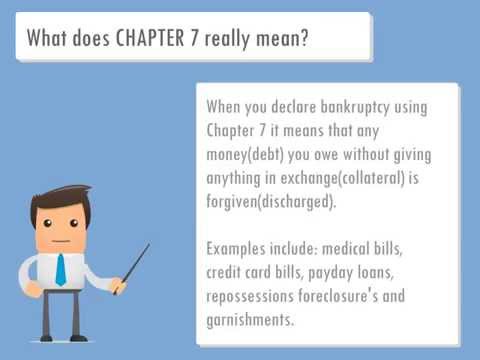

Probably the most common different types of personal bankruptcy is Chapter 7, also referred to as liquidation individual bankruptcy. It’s intended for individuals who've minimal to no disposable profits. In case you qualify, a Tulsa bankruptcy law firm can information you through the whole process of liquidating your non-exempt property to pay off your creditors. It would sound severe, nevertheless it’s often the fastest way to get rid of too much to handle credit card debt and start clean. The best part? You could possibly be financial debt-no cost in only a few months, supplying you with the economic liberty to rebuild your lifetime.

Over the flip aspect, there’s Chapter thirteen bankruptcy, and that is frequently often called a reorganization bankruptcy. In case you have a gentle revenue but are battling to keep up using your payments, Chapter 13 could be an even better choice. A Tulsa personal bankruptcy law firm will help you produce a repayment system that actually works for you, making it possible for you to definitely pay back your debts over a period of 3 to 5 years. The profit? You get to keep your property even though catching up on skipped payments. It’s like hitting the pause button on the financial anxiety, providing you with time and energy to get again heading in the right direction.

Now, let’s get genuine for any minute. Personal bankruptcy is frequently viewed as A final vacation resort, a remaining possibility when there’s no other way out. But that doesn’t mean it’s some thing for being ashamed of. Daily life takes place. Possibly you dropped your task, acquired hit with surprising health care charges, or went by way of a divorce. These things can occur to anybody, and sometimes, individual bankruptcy is the only real method of getting a clear slate. Tulsa personal bankruptcy lawyers understand this. They’re not in this article to guage you; they’re below that can assist you discover a way ahead.

A different issue to take into account may be the impact of individual bankruptcy with your long term. It’s legitimate that individual bankruptcy stays in your credit report for 7 to ten decades, depending upon the style of personal bankruptcy you file. But in this article’s the silver lining—the majority of people who file for bankruptcy have already got ruined credit history. The good news? Submitting for personal bankruptcy can in fact be step one towards rebuilding your credit score. With the assistance of a Tulsa individual bankruptcy lawyer, you can begin taking techniques to enhance your credit rating score appropriate after your personal bankruptcy is discharged.

You might be pondering about the expense of selecting a Tulsa individual bankruptcy lawyer. It’s a legitimate issue, especially when you’re previously dealing with economic complications. But here’s the issue—lots of bankruptcy attorneys present free consultations, and so they usually Focus on a flat charge basis. What this means is you’ll know what precisely you’re paying upfront, without any hidden expenditures. Visualize it as an investment decision with your money upcoming. The peace of mind that comes with realizing you've got a expert Qualified managing your circumstance is truly worth every penny.

Getting My Tulsa Bankruptcy Lawyers To Work

When it comes to timing, it’s never much too early to refer to by using a Tulsa personal bankruptcy lawyer. Even when you’re just beginning to drop powering on your expenditures, an attorney can assist you discover your choices. Individual bankruptcy might not be necessary at once, but obtaining a lawyer in the corner early on may help you keep away from creating highly-priced problems. They are able to recommend you on how to handle creditors, what techniques to get to shield your property, and when it'd be time to take into account bankruptcy as an answer.In the event you’re concerned about the stigma of personal bankruptcy, recognize that you’re not on your own. Many of us explore more truly feel humiliated or ashamed about filing for personal bankruptcy, however it’s essential to keep in mind that personal bankruptcy laws exist for any rationale. They’re created to give persons discover here a second likelihood, a method of getting back on their ft just after monetary hardship. Tulsa personal bankruptcy legal professionals have seen all of it, they usually’re here to let you know that there’s no disgrace in trying to find help. In reality, it’s among the list of bravest belongings you can do.

Bankruptcy isn’t nearly wiping out credit card debt—it’s about developing a improved long term. By removing the fiscal stress that’s been Keeping you again, you can begin specializing in the things that really make a difference, like Your loved ones, your occupation, along with your wellbeing. A Tulsa bankruptcy law firm will let you set a approach in spot for going ahead, so you can begin dwelling the lifetime you have earned. They’ll assist you established sensible aims, rebuild your credit rating, and develop a funds that works for you personally.

In the event you’re nonetheless around the fence about getting in touch with a Tulsa individual bankruptcy law firm, look at this: what do You will need to drop? In the very the very discover here least, a session will provide you with a greater idea of your choices and what to expect if you choose to go forward with individual bankruptcy. Expertise is electrical power, and the more you already know, the higher Geared up you’ll be for making the correct decision in your economic future. Recall, you don’t need to experience this on your own—assistance is only a cellular phone phone away.

While you weigh your options, keep in mind that bankruptcy will not be a 1-dimensions-fits-all Resolution. What works for one particular person might not be the only option for another. That’s why it’s so crucial that you have a Tulsa personal bankruptcy law firm who will tailor their suggestions on your specific predicament. They’ll take the time to acquire to be aware of you, understand your targets, and acquire a technique that’s customized to your requirements. No matter if you’re struggling with foreclosure, wage garnishment, or simply a mountain of bank card credit card debt, a Tulsa individual bankruptcy law firm can help you discover the light at the end of the tunnel.